Get your pay working

harder with Smart

All you need to know about the end of FBT year

The Fringe Benefits Tax (FBT) year is almost over! For more information on important dates and what you can do to be ready for the end of FBT year period, be sure to check out our handy “All You Need To Know” information site.

Salary packaging – it’s like giving yourself a pay rise

Welcome to salary packaging with Smart, the SA Government’s salary packaging provider. We’re here to help SA Government employees increase the money you have available to spend, by salary packaging certain expenses to reduce your taxable income.

Whether you’re full-time, part-time or casual, being smart with your benefits can really pay off.

Who can salary package?

All SA Government employees are allowed to salary package under Australian Taxation Office (ATO) rules, and there are lots of different expenses you can include.

What can you salary package?

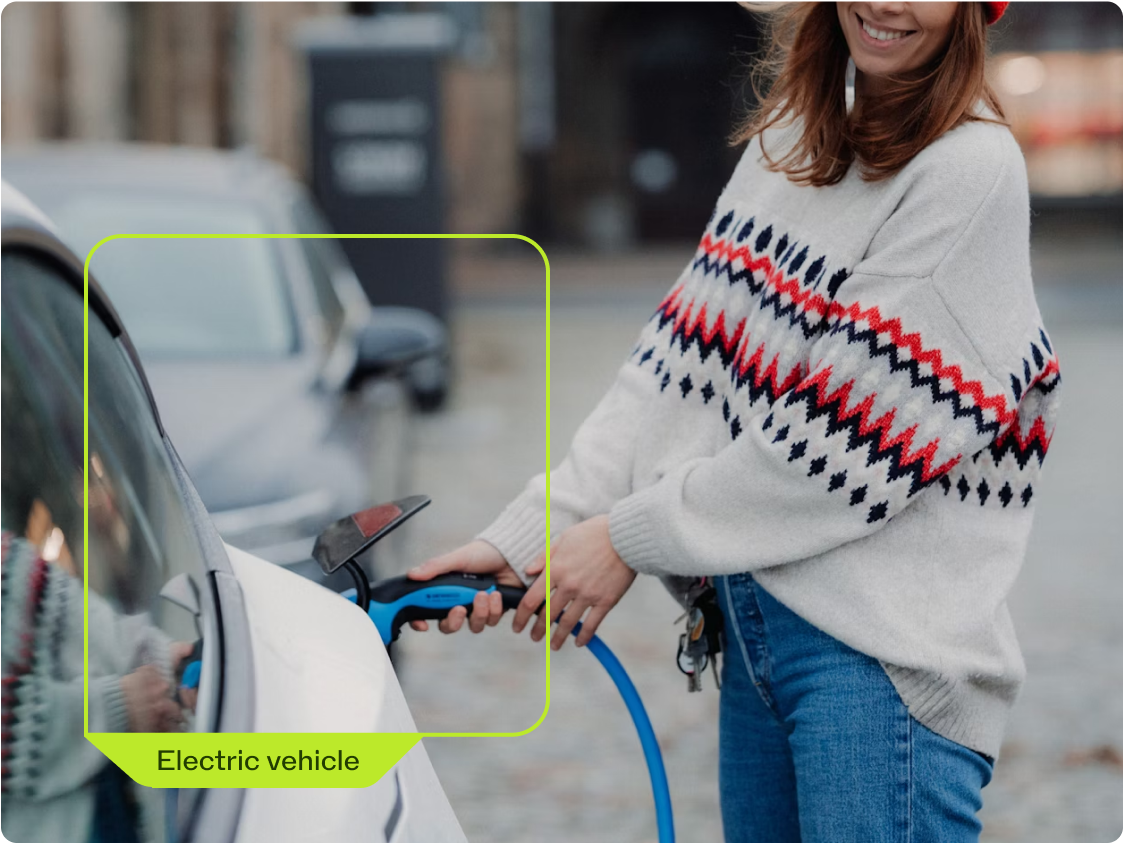

What you can package depends on which department or agency you work for. All SA Government departments and agencies allow their employees to salary package a car, also known as novated leasing. Many employees may also be able to save by salary packaging certain work-related expenses and professional memberships and subscriptions. If you work for a Local Health Network, SA Ambulance or the Legal Services Commission, you have the widest range of benefits available to you, including the ability to package certain everyday living expenses.

Drive away with 35,000 bonus Qantas Points*

A novated lease is one of the most tax-effective ways to buy and run a car. Drive away with 35,000 bonus Qantas Points* when you take out a novated lease through SmartTM.

Offer ends 31 March 2026. Terms and conditions apply.

What does your employer offer?

Local Health Network and SA Ambulance

You can salary package certain everyday living expenses (including home loan or rent payments), meal entertainment, work-related expenses, car leasing and many other tax-saving benefits.

Department for Education

You can salary package certain self-education expenses, work-related expenses, relocation costs, professional membership and subscriptions, car leasing and many other tax-saving benefits.

SA Police

You can salary package car leasing, certain work-related expenses, financial and taxation advice, income protection insurance, relocation costs and many other tax-saving benefits.

Department for Health and Wellbeing

You can salary package certain work-related expenses, self-education expenses, car leasing, relocation costs, professional membership and subscriptions, and many other tax-saving benefits.

Legal Services Commission SA

You can salary package certain everyday living expenses (including home loan or rent payments), meal entertainment, work-related expenses, car leasing and many other tax-saving benefits.

Other departments and agencies

Benefits available depend on which SA Government department or agency you work for, but they will include car leasing, certain work-related expenses and more.

See how much you could save

We make things simple

From setting up your benefits to managing ongoing expenses, we keep things streamlined and uncomplicated, through 24/7 access to our platforms and tools, and award-winning customer support and education.

We maximise your savings

As well as the tax savings through your benefits, we help you save in other ways, like sourcing your leased car at the most competitive price from our huge dealer network, and through the many discounts available with Smartrewards.

You can count on us

Around 500,000 Australians already enjoy salary packaging with Smart™, through hundreds of Australia’s government agencies and leading institutions. With 25 years’ experience and more Customer Service Institute of Australia (CSIA) awards than any other Australian salary packaging provider, you can be sure you’re in good hands.

Want to know more about salary packaging?

Important information

* This offer is only available to those whose employers allow them to finance a car through Smart. Smart may withdraw, change or remove this offer at any time. To be eligible for 35,000 bonus Qantas Points, individuals must do the following between 2 September 2025 and 31 March 2026: (1) submit the ‘Get a Quote’ form on https://www.smart.com.au/p/qantas-points/; (2) order a new vehicle through Smart; and (3) obtain finance for that vehicle through Smart. Individuals must be a Qantas Frequent Flyer member at the time of vehicle order and link their account as prompted by Smart. For the full terms and conditions of this offer please visit here.